Each year the ATO releases benchmarks for 100 Small Business Industries. Last week the ATO released the figures compiled from the 2023 Tax year data.

These Benchmarks allow small business to compare the performance of their own business against others of similar size in their industry. The figures are compiled using the information from the 2023 Tax Returns and Activity Statements lodged by businesses in each industry.

To provide an illustration of how these benchmarks can be used to compare your own small business, I've selected the industry - Plumbing Services to provide an example.

The category, Plumbing Services, includes businesses who install and repair plumbing, drainage, sewage and gas fittings.

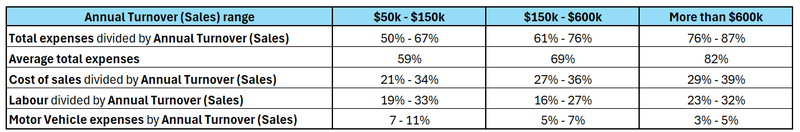

The table below provides the ATO benchmark figures for Plumbing Services:

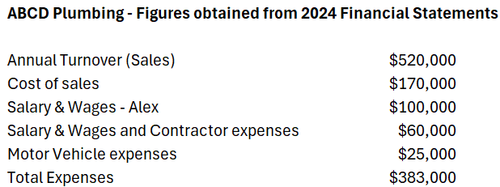

To explain how the benchmarks can be used to assess performance, we will look at Alex and their small business – ABCD Plumbing.

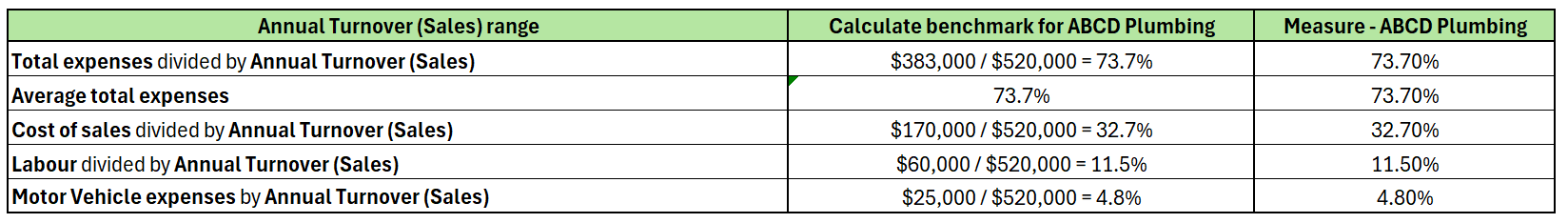

Using ABCD Plumbing's figures, we will then calculate their business performance:

* Note - Labour does not include any associates Salary & Wages

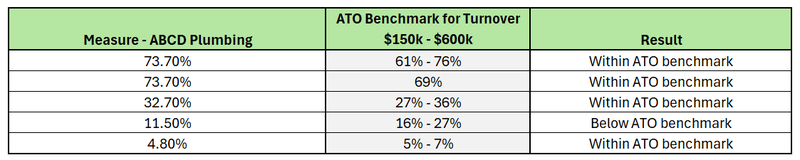

The next step is to compare ABCD Plumbing's measures against the ATO Benchmark in the applicable turnover range. As the turnover of ABCD was $550,000, we use the second column of the plumbing services benchmark range $150,000 - $600,000.

Each of ABCD Plumbing's measures were within the ATO Benchmark with the exception of Labour. The benchmark figure for Labour doesn't include any associated individual's Salary & Wages so this measure can be lower when these individuals perform a majority of the work.

What does it mean when a business measure falls outside of the ATO Benchmark range?

There are a variety of reasons why a business may be outside of the range. These may include:

Reporting above the range:

- Competitors can source inputs i.e materials at a lower cost

- Mark-up is lower

- Labour costs are too high

- Not all Sales are recorded

Reporting below the range:

- Mark-up is higher

- Your business operates more efficiently

- Some expenses may be recorded incorrectly or not at all

The ATO uses a number of tools to identify whether a business is avoiding tax and not meeting their obligations. The ATO Benchmark is one of these tools however it's important to note that the measure is not used on its own to target avoidance.

While the ATO benchmarks are a useful source if your industry is published, other industry and professional associations also research and compile their own benchmark figures.

If you would like assistance in analysing your small businesses performance with available benchmarks, please contact Cambrian Hill Accounting.

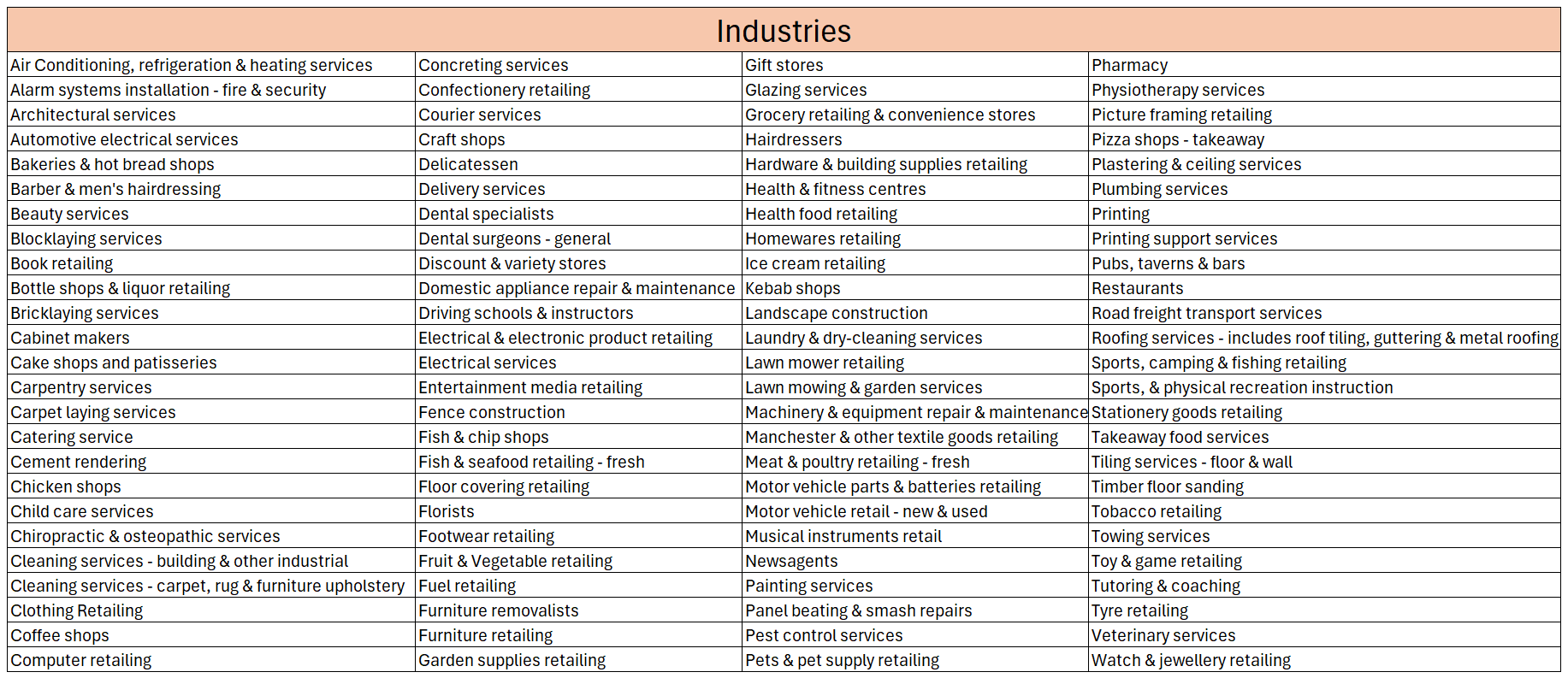

To see if your industry is included in the 100 categories of Small Business ATO benchmarks, check out the list below.